Senegal will raise nearly $10 billion over the next three years through tax increases, renegotiations of energy contracts, and spending cuts as part of a comprehensive plan to stabilise public finances and restore investor confidence, Prime Minister Ousmane Sonko announced on Friday.

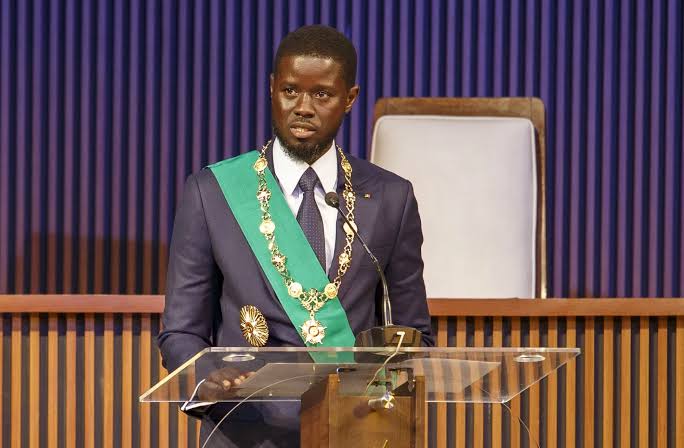

Speaking in Dakar, Sonko stated that the government will prioritise domestic resource mobilisation to reduce its dependence on external aid.

The measures follow the discovery of $7 billion in previously undisclosed borrowing by the former administration, which pushed Senegal toward a debt crisis, Bloomberg reported.

Under President Bassirou Diomaye Faye, the government plans to fund 90% of its economic recovery plan through domestic revenue, including new taxes on goods, services, and mobile money transfers. The aim is to generate 5.7 trillion CFA francs ($9.9 billion) throughout the period.

The fiscal misreporting prompted the International Monetary Fund (IMF) to suspend a $1.8 billion loan program last year, while S&P Global Ratings downgraded Senegal’s credit rating further into junk status.

The government’s new fiscal strategy is designed to reassure investors and restore credibility.

The IMF announced last week that it will begin discussions with Senegal in September toward a new financing arrangement, contingent on the country presenting a credible path back to fiscal sustainability.

However, financial markets remain cautious. Senegalese Eurobonds due in 2033 fell 0.7% to 73.98 cents on the dollar by Friday afternoon in London trading

Rebasing GDP

Senegal’s statistics agency is also working on rebasing the nation’s gross domestic product (GDP), a move that could improve the country’s debt metrics.

Following an audit, Senegal’s debt-to-GDP ratio surged to 99.7% in 2023 from a previously reported 74.4%. Economy Minister Abdourahmane Sarr stated that the country’s debt obligations stood at 119% of GDP last year.

A new IMF program, aimed at financing the recovery plan and regaining investor confidence, will depend on Senegal’s ability to demonstrate fiscal discipline.

Sarr said the government’s roadmap includes improving the efficiency of public spending, prioritising high-impact investments, and reducing the budget deficit to 3% by 2027.

While the government is considering debt reprofiling, extending maturities to ease repayment pressures, it remains committed to avoiding a full debt restructuring