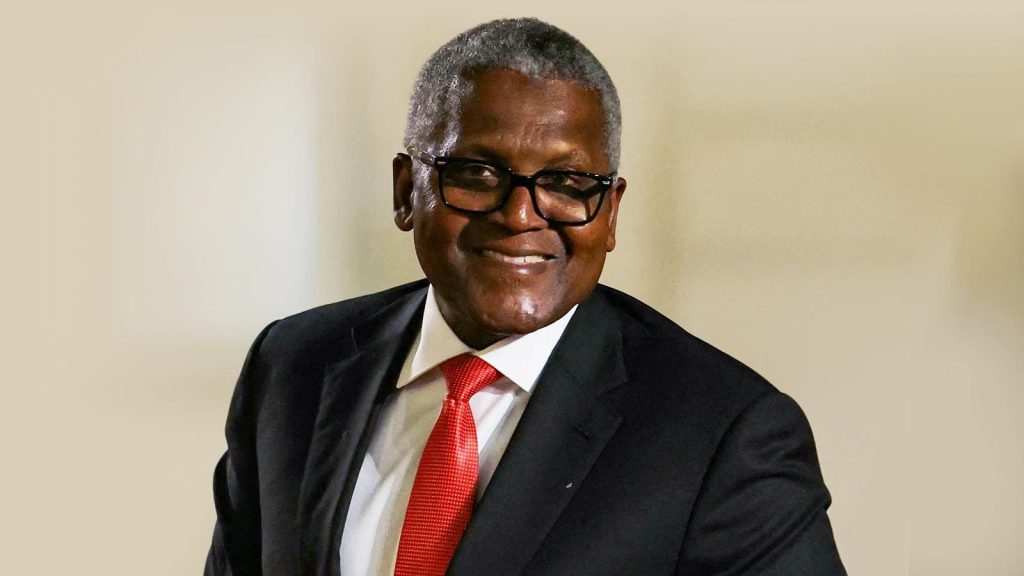

Aliko Dangote, Chairman of the Dangote Group, yesterday, unveiled plans to pay shareholders in US dollars when the company’s $20 billion oil refinery lists on the Nigerian Exchange Limited (NGX) next year.

Speaking in Lagos, Dangote said investors will purchase shares in naira but receive dividends in dollars, a model designed to shield Nigerian shareholders from the country’s currency volatility. “You buy in naira, but you get dividends in dollars,” he said, describing a framework being developed in collaboration with the NGX and the Securities and Exchange Commission (SEC).

The dollar payouts would be funded by $6.4 billion in expected revenue from petrochemical exports, including polypropylene and fertilizers, according to Dangote. The IPO will offer a 10 per cent stake in the refinery and petrochemicals complex, with the Nigerian market prioritized over potential international secondary listings.

The announcement forms part of the conglomerate’s broader growth ambitions, with Dangote Group projecting revenue of $100 billion by 2030, up from $18 billion today, and aiming for a market capitalization exceeding $200 billion. The group’s revenue has grown from $3.3 billion to $18 billion over the past five years, while EBITDA rose from $1.8 billion to $2.8 billion.

The success of the scheme depends on regulatory approval, the refinery’s ability to sustain foreign exchange inflows, and Nigeria’s broader macroeconomic environment, which has seen repeated pressure on the naira.

Some economists caution that dollar payouts in a foreign-exchange-constrained economy could complicate liquidity management for the company.

Despite these uncertainties, Dangote emphasized that the Nigerian market remains the priority. “We want the Dangote Refinery to be the golden stock of the exchange,” he said, highlighting the company’s confidence in its growth trajectory and its strategic importance to Nigeria’s energy sector.

With plans to expand petrochemical production and leverage export revenues, the Dangote Group is positioning itself among the world’s 100 largest companies