The Central Bank of Nigeria (CBN) has introduced new draft guidelines compelling banks to provide instant refunds for failed Automated Teller Machine (ATM) transactions.

The rules, released on October 9, 2025, are designed to strengthen consumer protection, improve service reliability, and ensure greater accountability in Nigeria’s financial system.

The circular, signed by Musa I. Jimoh, Director of the Payments System Policy Department, was addressed to banks, payment service providers, card schemes, and independent ATM deployers. Stakeholders have until October 31, 2025, to provide feedback before the guidelines are finalised.

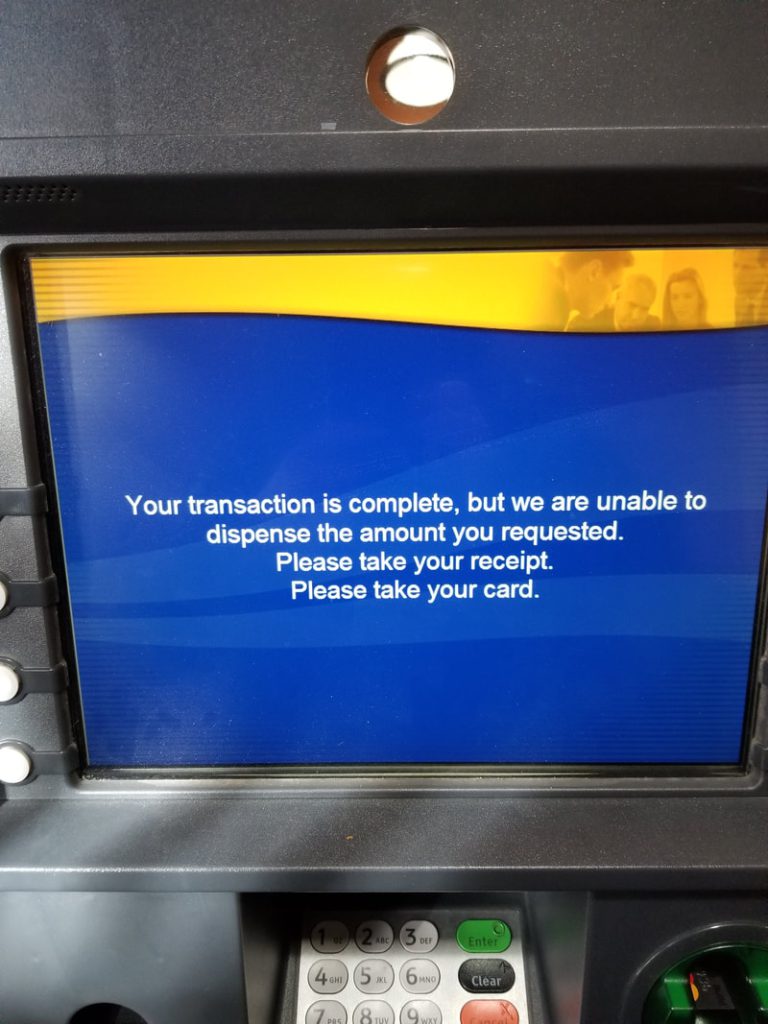

Strict timelines for failed transaction refunds

Under the draft framework, all on-us transactions—where a customer uses their own bank’s ATM—must be reversed instantly. The CBN noted that if instant reversal is not possible due to technical hitches or system glitches, the transaction must be manually corrected within 24 hours.

For not-on-us transactions—where customers use another bank’s ATM—the maximum refund window has been set at 48 hours.

ATM acquirers are also required to put in place mechanisms that automatically initiate refunds without waiting for customer complaints or prompts from the issuing bank. In addition, they must reconcile and refund all funds in their possession that belong to customers as a result of failed or partial cash disbursements.

The CBN emphasised that this measure is aimed at improving consumer confidence in the banking system and reducing the frustration often associated with delayed transaction reversals.

Broader reforms to ATM deployment and operations

The refund directive is part of a wider overhaul of Nigeria’s ATM regulatory framework, which replaces earlier provisions in the 2020 electronic payments guidelines. The CBN explained that the review was necessary in light of the rapid evolution of the payment’s ecosystem, rising cyber threats, and the push to expand financial inclusion.

The new rules require banks and card issuers to deploy a minimum of one ATM for every 5,000 cards issued. This target will be phased in over three years, with 30% compliance expected in 2026, 60% in 2027, and full compliance by 2028. Any deployment, redeployment, or decommissioning of ATMs will require prior approval from the apex bank.

ATMs must also meet higher operational standards. They are to be fully compliant with Payment Card Industry Data Security Standards, maintain detailed audit logs for dispute resolution, and provide clear card orientation symbols.

At least 2% of all ATMs deployed by each bank must be equipped with tactile symbols to serve visually impaired customers.

Machines must be sited in secure, well-lit areas, fitted with anti-skimming devices, and backed by surveillance cameras that monitor transactions without recording keystrokes.

Customer convenience also features prominently in the draft rules. ATMs must dispense cash before releasing cards to reduce the risk of abandoned cash, provide receipts when requested, allow free personal identification number (PIN) changes, and ensure that only fit banknotes are dispensed. Operators are also mandated to provide backup power, functioning helpdesk lines, and screen prompts that offer users more time to complete transactions.

What you should know

The apex bank stated that it would enforce compliance through regular audits, on-site inspections, and mandatory monthly reports from ATM operators listing all new deployments and their locations. Institutions that fail to comply with any part of the guidelines will face penalties, though the circular did not specify the scale of sanctions.

By setting strict timelines for failed transaction refunds and overhauling operational requirements, the CBN hopes to improve reliability in ATM services, reduce customer complaints, and align Nigeria’s payment system more closely with international standards.

The fresh guidelines come nearly eight months after the CBN announced a major revision to its ATM transaction fees, effectively eliminating the three free monthly withdrawals previously granted to customers using other banks’ ATMs